Leased Ad Space

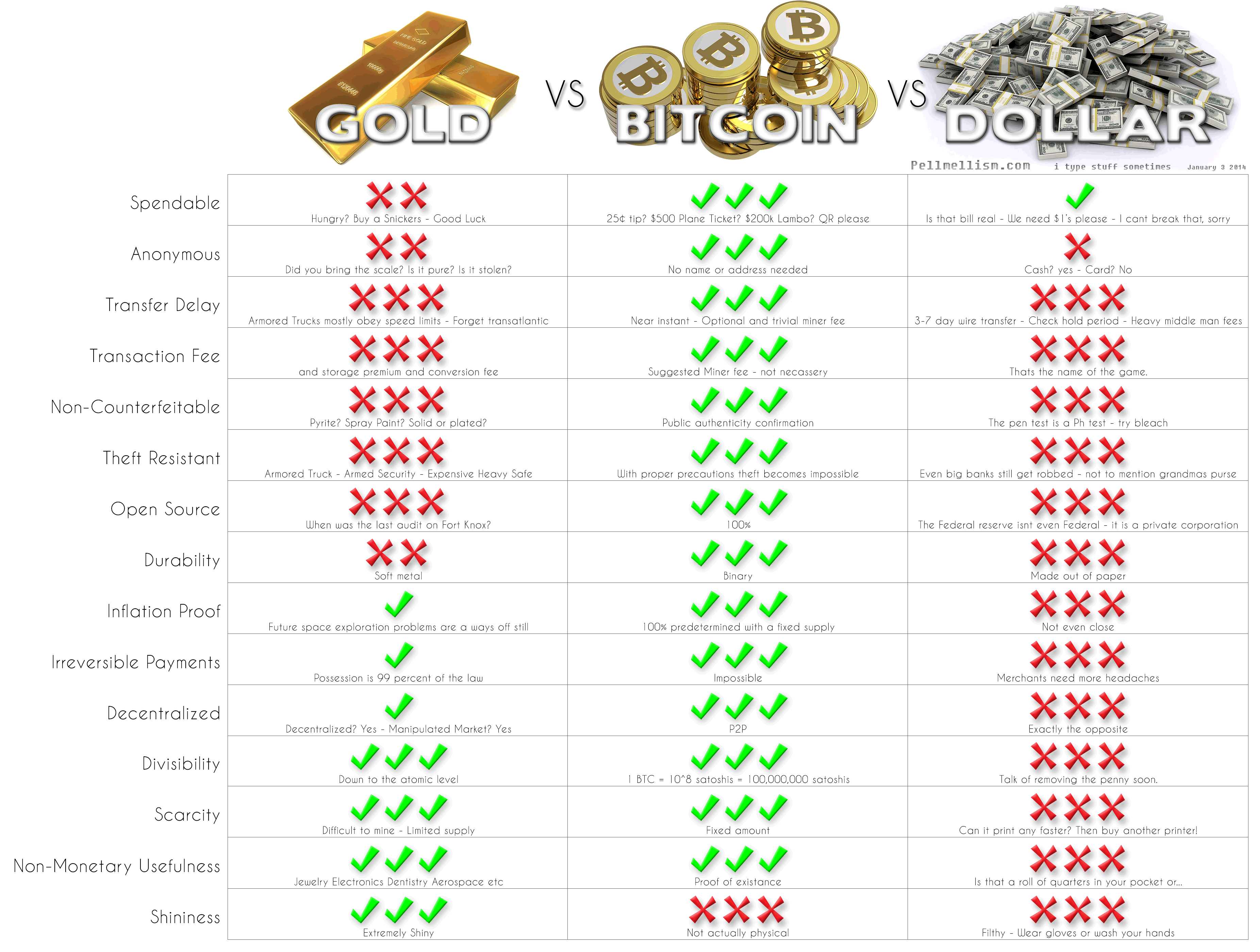

Cryptocurrency is much better than fiatcurrency (real money) let me explain...

Published by Chre Majano — 06-06-2017 03:06:07 AM

Why cryptocurrency is better than fiatcurrency?

How? A concrete example can be found when looking at the money making process. The amount of money of a crypto coin can not be manipulated and all rules are mathematically recorded. It is not a fiat digital money (such as the Euro/Dollar) that can be digitally enlisted in uninitiated amounts in the form of debt. The practice of fractional banking is by definition excluded. There are no banks to accommodate. Of course, banks could always develop a fiat crypto coin that is centrally managed by the bank and can be unlimited. This would immediately be avoided by anyone with a bit of IQ, provided that people by decree (fiat) are forced by the government to use this centrally managed crypto coin for paying taxes and interest on outstanding debts.

Another concrete example is the operation of the payment system. All international financial transactions, cross-border transfers and payments, run through centrally-led banking telecommunications systems such as the SWIFT system. Within Europe, we have been making the SEPA system since 2008. The purpose of the SEPA is to create one major European banking market, which makes no difference between domestic and foreign transactions. All transactions take place using the IBAN bank account numbers managed by the banks. All transactions take place within one payment system in the hands of the banks and, in fact, never leave a bank. In addition, the digital euros on your bill are in fact not your inalienable property and are connected to a third party risk: the health of your bank. These are digital funds that are insured up to 100,000 euros by the government in case of bankruptcy. A haircut on your savings is also a potential for a banking system crisis. Look, only if the digital euro is included as cash, then it's only outside the control of banks and governments. Cash goes directly from one stock exchange to another exchange without a bank performing and checking this transaction.

This is also the case when you pay with a cryptocurrency. A cryptocurrency works with the help of a global peer-to-peer network without limits. It goes straight from one computer to another computer and every computer is equivalent in every way in the world. There is no central server that acts as a central bank for the issue of the digital currency. It also means that it does not cost anything to receive and send money. Unnecessary costs are avoided. Therefore, a cryptocurrency is also called digital cash. That's why we talk to cryptocurrencies about wallets / wallet items that you own directly and not about bank accounts. A transfer will take place immediately from one stock exchange to another without the intervention of banks.

One other concrete example is that the value of digital cryptocurrency functions on the basis of natural market performance on demand and supply ratios. This market operation can be further strengthened by expanding a related p2p economy and implementing new applications. Thus, cryptocurrency can also be tied to the market value of other goods in the real world such as property rights or precious metals such as gold, palladium, silver, a diamond or an art object! It's no wonder that governments and banks are afraid of the drowning power of cryptocurrencies. They will fear the citizens to use this liberating technology and try to discourage their use. And if possible, to prohibit.

Learn all about cryptocurrency with me here at iCoinPro.

Sincerely,

Chre Majano.

About Chre Majano

Hi, my name is Chre Majano and i'm from the Netherlands. My main focus is in the crypto industry. That's why they call me a Crypto Hoarder ;-)